Detroit's expensive rent problem worsened during Covid and may not improve until 2024

$203 million to be invested in Detroit to build more affordable housing

The city of Detroit will get more than $200 million to build more affordable housing by fixing vacant lots, abandoned buildings.

DETROIT (FOX 2) - Detroit's affordable housing issues, already suffering from a lack of availability, will get worse before they get better.

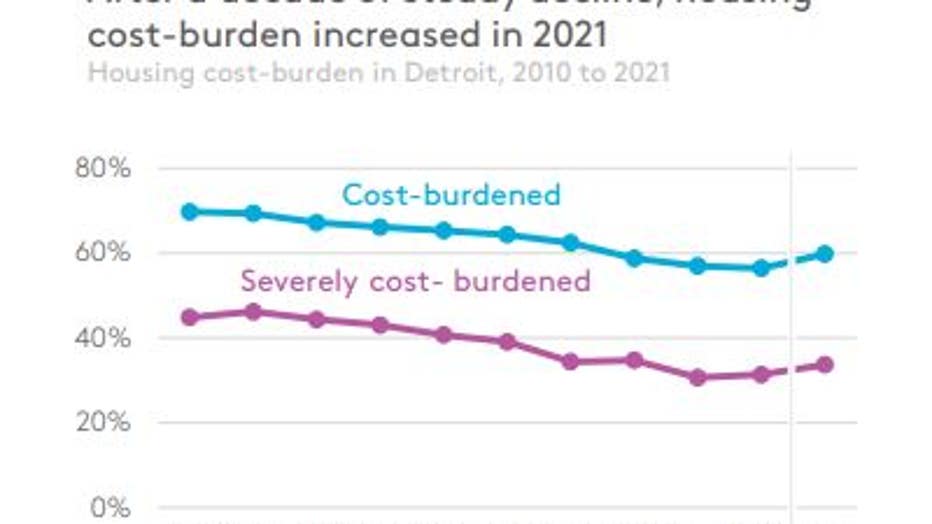

A summary of city's incomes, employment, and rental rates in Detroit found the number of people burdened by their housing costs went up in 2021. It was the first major increase after a decade of improving housing cost issues in the city.

As a red-hot housing market cools, experts who study housing in Detroit anticipate it will be another couple years before rental rates follow.

"We were concerned generally (about affordable housing), but during the pandemic, things were so upside down, and it became really clear that people living in the bottom quadrant of the income scale were not being supported," said Anika Goss, the executive director of Detroit Future City.

The report underscores just how dramatic an impact the COVID-19 pandemic had on Detroit's housing stock and its citizens' ability to manage the economic fallout over the past two years. It may take another two for things to even out.

"If rent softens and people are back to work in 2022, we might see an evening out," Goss said. "I'm hoping in a year or two years, we'll see some things come down."

RELATED: This is how much money you need to make per hour to afford rent in Michigan

Over the past 10 years, the number of Detroit renters spending over half of their income on housing peaked in 2011. After a decade of gradual declines, it plateaued in 2019 and then rose in 2021. According to the American Community Survey, it was driven by a 9% drop in available rental housing.

Data from American Community Housing Survey,

As cheap housing dried up further, Detroiters' income stayed the same. Employment also fell exclusively among Black residents who represent the poorest demographic in the city.

"Employment is high, but not for everyone. Many people are not back to work and a lot of them are still renting," Goss said. "And now, the margins are much smaller between how much their household expenses are - which are probably higher - and how much their rent actually costs."

Untangling Detroit's housing woes isn't easy, especially after the pandemic-induced whiplash that tore through the past two years. Part of the reason is Detroit's rents are subject to the average incomes across the metro region - not just the city. That's a problem for Detroit households with an average income of $36,000 - almost half of the median income in Metro Detroit.

The city alleviates some of that burden by subsidizing rent in tens of thousands of units. But according to Goss, that only makes up about a quarter of the 125,000 rental units in Detroit. These inequities were present prior to the pandemic.

The job market was already problematic for residents who worked in the city before COVID-19 disrupted things. Those that went looking for a job found the only work that was growing were in the low-wage sector. "These are often not stable and not secure-growth jobs," Goss said. "They're at the very bottom of the payroll employment sector. And they're often the jobs that are cut first."

Meanwhile, the housing market took off in 2021, which priced out many prospective owners that may have considered buying a home if they were cheaper. The moratorium on evictions in rentals along with checks from the federal government helped keep people housed in 2020.

MORE: Ann Arbor neighborhood to be 100% 'net-zero,' run on solar power and geothermal energy

But as the moratorium expired, rental rates responded to a surge in people avoiding the housing market.

"High rent is a reflection of the for-sale market," Goss said. "A lot of people decided to rent to wait out the foresale market since it was so out of control. Even now, if prices are coming down, people are still waiting since it's not a good time to get a mortgage."

The softening of the housing market isn't reflected in the ACS report, which Goss believes will help lead to lower rent. It may take time for things to even out however since interest rates are rising and inflation is persistently high.