Home values rising in Detroit, especially for Black homeowners, study shows

Study: Property value for Detroit Black homeowners is rising

A new University of Michigan study based on 9 years of recorded home sales data estimates that Detroit’s Black homeowners gained nearly $3 billion in home value between 2014 and 2022.

DETROIT (AP) - Home values in Detroit — especially for Black residents — have increased by billions of dollars in the years following the city’s exit from the largest municipal bankruptcy in U.S. history, according to a study released Tuesday.

The University of Michigan Poverty Solutions report says added home value for Black residents increased 80% between 2014 and 2022.

For Black homeowners, estimated home values rose from $3.4 billion to $6.2 billion over that period, while the net value of all owner-occupied homes in the city increased from $4.2 billion to $8.1 billion.

"For decades, Detroit’s homeowners saw their family wealth evaporate as home values declined," Mayor Mike Duggan said Tuesday at a news conference announcing the study’s findings. "Now, those who stayed, most notably Black homeowners, have gained nearly $3 billion in new generational wealth because of our city’s neighborhoods comeback."

"When I got sworn in 10 years ago there were 1,000 people a month leaving this city," Duggan added. "People were bailing out on Detroit right and left. Those who stayed are $4 billion better off because they bet on the city of Detroit."

With the city facing a budget deficit north of $300 million and debt of $18 billion or more, a state-appointed manager filed for bankruptcy in July 2013. Detroit exited bankruptcy in December 2014 with about $7 billion in debt restructured or wiped out. Since that time, the city has produced balanced budgets and surpluses, improved services and reduced blight.

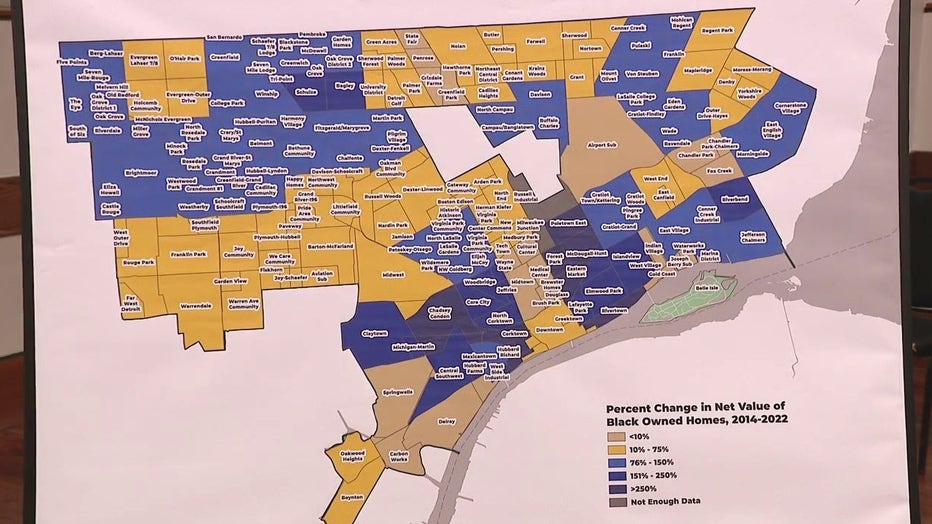

Much of Detroit’s improvements are visible in its vibrant downtown and Midtown areas, but increased home values were geographically dispersed in neighborhoods across the 139-square-mile (360-square-kilometer) city.

Neighborhoods among the poorest in 2014 — especially those with high concentrations of Hispanic and Latino residents — showed the most growth in home and property value, the University of Michigan study said.

The average home sale price in 2014 for homes in the Condon neighborhood was about $7,500. By 2022, the price was more than $71,000.

Helping the turnaround has been a 95% reduction in tax foreclosures since 2016 across Detroit, according to the study.

Detroit’s overall population is about 639,000, according to the 2020 Census. About three-quarters of the city’s residents are Black.

Black homeowners represented 82% of all housing wealth generated in 2014 and 77% in 2022, according to the study.

White homeowners in Detroit had the second largest share of net housing wealth, accounting for 11% of net wealth in 2014 and 13% in 2022. Hispanic homeowners had 4% and 6%, respectively.

Melvin Chuney, who is Black, says the value of his home has tripled.

"It’s amazing and it’s real," Chuney said at Tuesday’s news conference. "It’s way more valuable than 10 years ago. People are fighting to get into this neighborhood that people were walking away from just a few years ago."

Duggan was elected mayor in November 2013 and has guided the city’s comeback since the start of 2014. He announced last week that Detroit has surpassed $1 billion in combined public/private investment that has created more than 4,600 affordable rental units over the past five years.

Over the past few weeks, two rating agencies also have raised Detroit’s credit rating to investment grade.

"Ten years on from its bankruptcy filing, Detroit’s financial position and economic condition are the strongest they’ve been in decades," S&P wrote in its report. "Liquidity and reserves are at record levels, the debt burden is manageable, population decline is flattening, the stock of blighted and vacant properties is down considerably thanks to extensive city-managed programs, assessed property values have increased in five consecutive years."