Some gambling losses can be claimed on state tax deductions with new law

New Michigan law will allow some gambling losses to be deducted on taxes

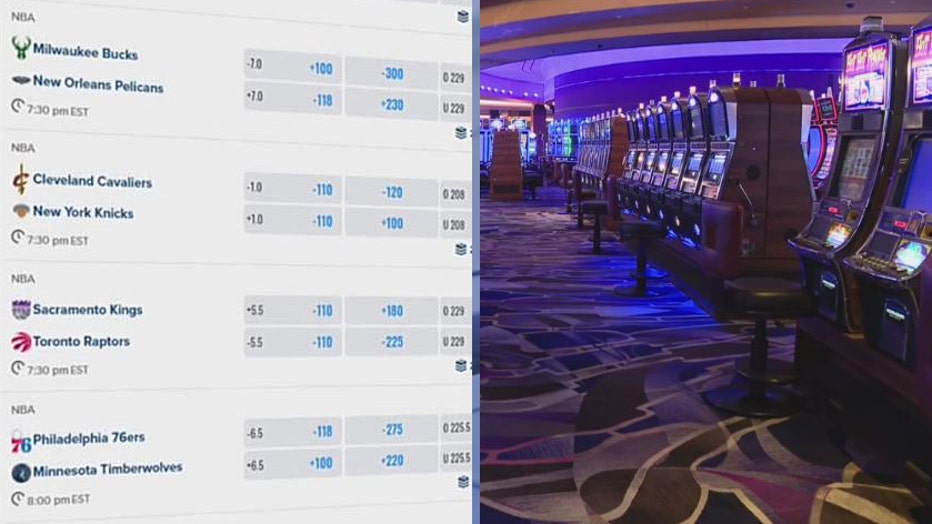

Since the pandemic started and Michigan legalized sports betting and launched online sports books and casinos, thousands of more people have entered the gambling market.

FOX 2 (WJBK) - Michigan will let gamblers claim a state income tax deduction for gambling losses - starting with 2021 - because of a new state law just signed by Gov. Gretchen Whitmer.

"It’s a good thing - you have to claim if you win big, why not claim the losses too," said Amy Shuman.

"It’s good by helping some people – but if you are not winning or losing a lot, it doesn’t help at all," said Leroy Overton.

"Not only do we win, we lose, so it is a big help - because a lot of elderly people are afraid to claim their money, because they think they will have to pay taxes on it later," said Shirley Wallace.

This is something gamblers who have been keeping track of their wins and losses, have only been able to do under federal law - until now.

Michigan is expected to lose between $12 million and $17 million in revenue. So what's the incentive?

FOX 2 spoke to Mike Foguth - president and founder of Foguth Financial.

"I think it is going to draw more casinos in – more online betting," he said. "Right now, Michigan is deemed to be a hub for online gambling, and I think you are going to see more.

"It’s kind of like when you saw the incentive for movies, why would you do that? Why would you do tax breaks for businesses – because it’s going to attract more business. That is really the only logic behind it."

Since the pandemic started and Michigan legalized sports betting and launched online sports books and casinos, thousands of more people have entered the gambling market.

Before the law was enacted, you only had to claim your winnings.

"The law says if you win more than $300 you should claim it as income – regular income just like your W-2," Foguth said. "I don’t think a lot of people are doing that already. Right? So it is one of those scenarious out there, where it is going to impact the bigger people out there, who will have losses they can carry over - especially with online gambling."

"Make sure you play your card so they can keep up with your losses also," Wallace said. "Hopefully it will balance off."

Betting online keeps track of deposits, everything you spend and cash out. If you plan to write off your losses in a casino in 2021 and beyond, be sure to keep track even if it is the old-fashioned way.

And to be clear, if you bet $3,000 and lost $3,000 you can't deduct that amount. You actually have to have winnings to deduct losses, and then you can only deduct what you won.