State road groups want electric vehicle owners to make up for lost revenue from gas tax

Michigan road groups want EV owners to pay up for avoiding gas tax

While owners of gas driven vehicles are paying the state gas tax at the pump, electric vehicle drivers are not paying it when they pump more electricity into their cars.

LANSING, Mich. (FOX 2) - While owners of gas-driven vehicles are paying the state gas tax at the pump, electric vehicle drivers are not paying it when they pump more electricity into their cars.

A coalition of road-building interest groups want those EV owners to pay their fair share otherwise the state will continue to lose road repair dollars.

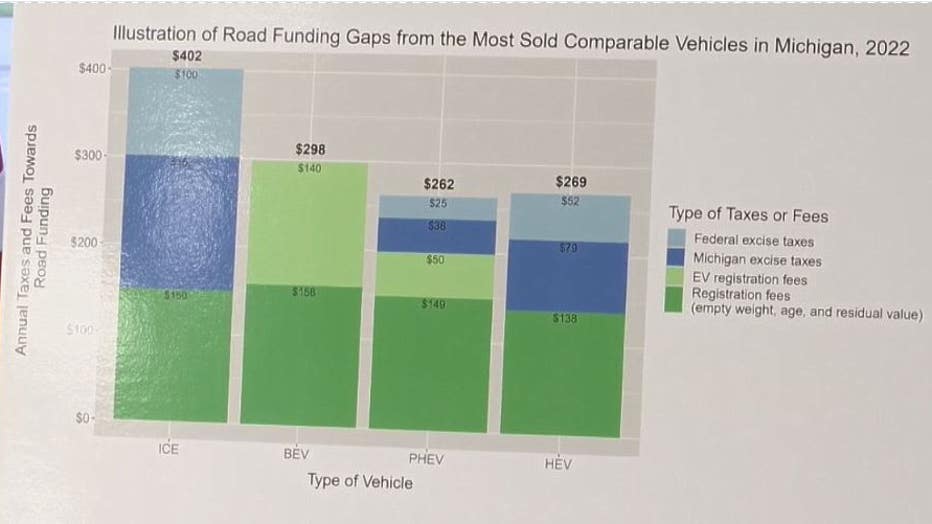

"A typical vehicle driver pays over $400 a year in road taxes." said researcher Patrick Anderson. "If you look at the EV drivers, we are using more common ones, they pay just 70 to 80 percent. That is a gap of over $300."

State lawmakers have already imposed a higher registration fee on EVs, but the coalition wants that to be increased.

They also want a pilot program whereby EV owners pay a fee, based on the miles they drive - the VMT fee. And they would have to register their vehicle miles with the Secretary of State's Office each year on the so-called honor system.

The coalition always wants lawmakers to explore toll roads which has been talked about for years, but have never been done.

The Michigan County Road Association argues the state is losing $50 million a year in part, to EVs on the road. And that number could reach $95 million over the years.

So what is the impact of with what yearly impact of road repairs?

"(About) 840 miles of road will not be able to be resurfaced per year," said Denise Donahue of the roads association. "That is a distance from the city of Monroe to Techqauemna Falls and back again."

At least from a philosophical standpoint, Gov. Gretchen Whitmer supports the effort to find some increase in fees for electric vehicles.She has not endorsed a specific plan.

The environmental lobby is not against the MVT system but it argues the EV owners should not be double-taxed.

"Give them a choice not to pay that surcharge, but to pay the VMT-based fee instead," said Charles Griffith, of the Ecology Center.

So far the coalition does not have any of their suggestions in the legislative hopper.