With stock markets tumbling, residents increasingly worried over 401(k) and retirement plans

BRIGHTON, Mich. - As fears over the coronavirus persist and governments enact new regulations to prevent the spread of the disease, the stock market is becoming more volatile.

On Thursday, the Dow Jones recorded its largest single-day drop ever. The S&P 500 also plunged 12 percent from its all-time set a week ago.

But what about retirement plans tied up in those stocks?

"Absolutely we should be worried now," said Michael Foguth, a financial advisor at Foguth Financial Group 5. "It's impacting the flow of everything. Our imports, our exports, it's affecting our emotions."

Following coronavirus news, the stock markets are spooked. Should you be too?

The stock markets have seen some of their sharpest declines ever this week as new concerns over the coronavirus have persisted.

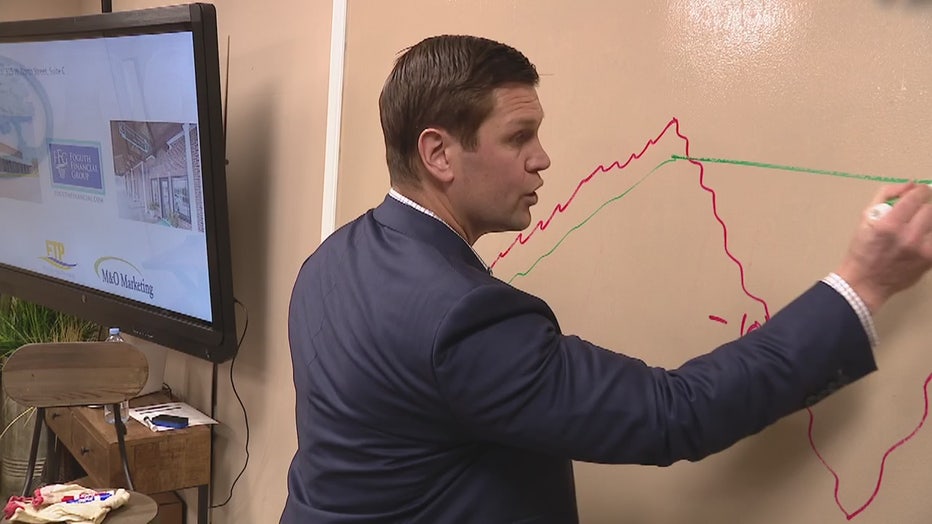

Foguth lectured financial advisors from around the country in Brighton on Tuesday, guiding them during a chaotic week on Wallstreet. So for concerned retirees whose retirement plans move with the markets, what might the appropriate advice to take? It depends.

Anyone who takes their income from stock investments should be concerned, says John Mills, a financial advisor from Georgia who attended Foguth's class.

"If you don't have the stomach for the downturn, then you should take an action and make changes to your portfolio," said Victoria Klingler, of Federal Benefits and Retirement Resources in Maryland.

RELATED: Dow Jones sinks 1,200 points as coronavirus worries deepen

Foguth emphasized that stocks fluctuate all the time. While the coronavirus is a driving force behind the market's decline, it's not the only factor. Just because the market was dropping wasn't a reason to panic, either.

"If you're too close to retirement, get out," he said. "(If I'm) 30 years old, I got time for this 10 to go back to 20 or recover. You're probably not worried about it. Maybe it's time to buy more."

"The best thing to do is to stick with your plan or take action if you can't take the risk," said Klingler.

"Most of your money should actually be in the more secure investments and a little bit less, percentage-wise, in stocks," said Mills.