Secret Service recovers $286 million in stolen pandemic loans

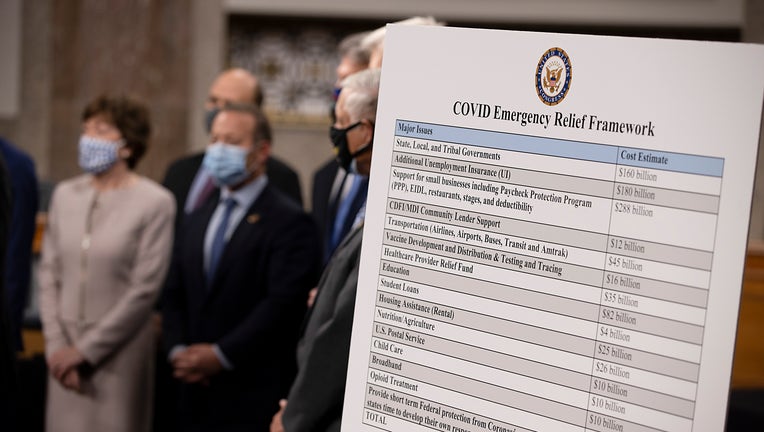

A bipartisan group of Democrat and Republican members of Congress as they announce a proposal for a Covid-19 relief bill on Capitol Hill on December 01, 2020 in Washington, DC. (Photo by Tasos Katopodis/Getty Images)

WASHINGTON - The U.S. Secret Service said Friday that it has recovered $286 million in fraudulently obtained pandemic loans and is returning the money to the Small Business Administration.

The Secret Service said an investigation initiated by its Orlando office found that alleged conspirators submitted Economic Injury Disaster Loan applications by using fake or stolen employment and personal information and used an online bank, Green Dot, to conceal and move their criminal proceeds.

The agency worked with Green Dot to identify roughly 15,000 accounts and seize $286 million connected to the accounts.

"This forfeiture effort and those to come are a direct and necessary response to the unprecedented size and scope of pandemic relief fraud," said Kevin Chambers, director for COVID-19 fraud enforcement at the Justice Department.

RELATED: White House claps back at lawmakers who criticized student loan relief after PPP loans were forgiven

Billions have been fraudulently claimed through various pandemic relief programs — including Paycheck Protection Program loans, unemployment insurance and others that were rolled out in the midst of the worldwide pandemic that shutdown global economies for months.

In March, the Government Accountability Office reported that while agencies were able to distribute COVID-19 relief funds quickly, "the tradeoff was that they did not have systems in place to prevent and identify payment errors and fraud" due in part to "financial management weaknesses."

As a result, the GAO has recommended several measures for agencies to prevent pandemic program fraud in the future, including better reporting on their fraud risk management efforts.

Since 2020, the Secret Service initiated more than 3,850 pandemic related fraud investigations, seized over $1.4 billion in fraudulently obtained funds and helped to return $2.3 billion to state unemployment insurance programs.

The latest seizure included a collaboration of efforts between Secret Service, the SBA's Inspector General, DOJ and other offices.

Hannibal "Mike" Ware, the Small Business Administration's inspector general, said the joint investigations will continue "to ensure that taxpayer dollars obtained through fraudulent means will be returned to taxpayers and fraudsters involved face justice."